Shares of Blackstone Inc. fell sharply on Wednesday after Donald Trump said he plans to ban large institutional investors from buying single-family homes, a move he described as aimed at improving housing affordability.

In a Truth Social post on Wednesday, Trump said he is “immediately taking steps to ban large institutional investors from buying more single-family homes” and will urge Congress to codify the proposal into law.

- Donald Trump announced plans to ban large institutional investors from buying single-family homes to improve housing affordability.

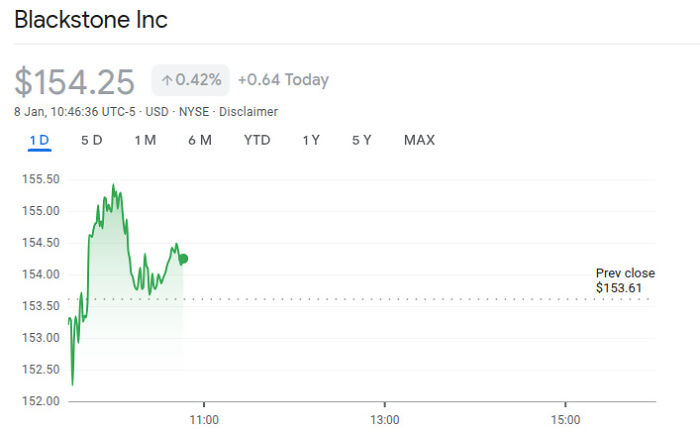

- Blackstone shares fell about 5.6% after Trump's announcement, reflecting market concerns over potential restrictions.

- Blackstone owns over $1 trillion in assets and has heavily invested in U.S. single-family rental homes recently.

The announcement triggered declines across housing-related stocks in U.S. markets, with Blackstone’s share price down about 5.6% during the trading session.

Blackstone shares plummeted after Donald Trump’s announcement

Image credits: Alex Wong/Getty Images

Blackstone is one of the world’s largest alternative asset managers, with more than $1 trillion in AUM (assets under management).

The firm has become a significant investor in U.S. residential real estate in recent years, including single-family rental homes and apartments.

Other companies involved in the single-family rental market also saw their shares fall after Trump’s announcement.

Shares of American Homes 4 Rent fell about 11%, while Invitation Homes Inc. slid roughly 10% and Builders FirstSource Inc., which supplies materials to homebuilders, dropped by more than 5%.

Blackstone ( $BX ) fell over 5% yesterday following President Trump comments on restricting institutional participation in housing. That said, single-day moves of this magnitude are not uncommon for $BX. Nothing out of the ordinary. pic.twitter.com/oLtXmavs3l

— Bluekurtic Market Insights (@Bluekurtic) January 8, 2026

Trump said the move is intended to help make homeownership more attainable for Americans, saying “people live in homes, not corporations.”

“For a very long time, buying and owning a home was considered the pinnacle of the American Dream,” he wrote on Truth Social.

“It was the reward for working hard, and doing the right thing, but now, because of the Record High Inflation caused by Joe Biden and the Democrats in Congress, that American Dream is increasingly out of reach for far too many people, especially younger Americans.

“It is for that reason, and much more, that I am immediately taking steps to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it.”

🚨🚨🚨🚨This is HUGE! 🏡 pic.twitter.com/49i8Huufal

— Karoline Leavitt (@PressSec) January 7, 2026

In 2021, Blackstone acquired Home Partners of America in a deal valued at about $6 billion, adding roughly 17,000 rental properties to its portfolio, according to Financial Advisor.

Then, in 2024, it completed the $3.5 billion purchase of Tricon Residential, a Toronto-based company with around 38,000 U.S. rental houses.

Critics argue that Blackstone’s large-scale home purchases have added pressure to an already tight housing market, saying the firm’s buying activity has reduced the number of homes available to individual buyers and contributed to rising prices.

Experts say it is unlikely Trump’s proposal would make a difference

Image credits: Google Finance

Blackstone has said it owns less than 1% of available housing in the markets where it operates, and it typically renovates properties before offering them for rent.

Experts have said it is unlikely that Trump’s proposal, if it passes, will result in more houses becoming available or lower costs.

Scott Lincicome, vice president at the Cato Institute, a Washington-based libertarian think tank, told MarketWatch that large institutional investors were minor players.

He said that Trump’s plan was “Populist Policy 101,” adding, “Pick a villain and blame it for a real problem even though it is a minor, if not totally insignificant, player in causing it.”

Image credits: Ben Hasty/MediaNews Group/Reading Eagle via Getty Images

“Institutional investors are a tiny share of the market, and a tinier share of the total U.S. housing market. There is not good enough evidence that institutional investors drive up home prices,” he said.

Jake Krimmel, a senior economist at real estate platform Realtor.com, also told the outlet that institutional investors “are a red herring for the affordability issues or the housing shortages issues that we’ve seen.”

“It plays really well politically, of course, but the unfortunate reality is that even if we remove these guys from real estate, it would not have a large enough impact to really move the needle on affordability,” he added.

The White House did not provide detailed policy text on how the proposed ban would be implemented or what legal authority would be used.

Trump said he would discuss the topic, including further housing and affordability proposals, during his speech in Davos in two weeks time.

15

0