When the tanker Midnight Voyager switched off its transponder in the Ionian Sea earlier this month, few noticed.

Within hours, its flag changed from Panama to the Comoros, and crude from Russia’s Baltic Kirishi terminal was pumped onto another vessel in open water.

By the time the oil reached an Indian refinery, its paperwork showed nothing Russian at all.

- Russian oil exports persist despite sanctions, using a 'shadow fleet' of older tankers with switched flags and covert ship-to-ship transfers.

- Ukraine's strikes reduced Russia's oil refining capacity by 20%, targeting supply chains amid rising sanctions and maritime pressures.

- Western sanctions like the $60 price cap sparked a complex cat-and-mouse game, but loopholes keep Russian oil flowing and financing Moscow.

This is what sanctions look like in 2025: complicated, porous and full of quiet workarounds. Western governments have spent nearly three years trying to choke off the Kremlin’s energy income. Yet Russian oil still flows—just more secretly, more circuitously, and often through a growing “shadow fleet” of mystery tankers.

Oil tanker “Eventin” of Russia’s shadow fleet. Image credits: Stefan Sauer/picture alliance via Getty Images

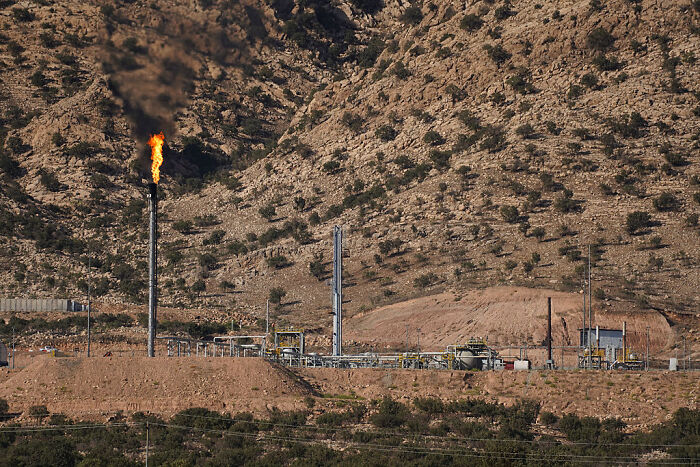

In October 2025, Volodymyr Zelenskyy announced that Russia’s oil-refining capacity had been reduced by about 20%, thanks to deep-penetration strikes from Ukraine’s long-range missiles and drones targeting major refineries.

The timing is significant: just as global sanctions and maritime pressure sought to squeeze Russian oil exports, this kinetic campaign turned inland, threatening the supply-chain backbone of Moscow’s hydrocarbon revenue model.

The dual pressure on shipping, pricing, and refining tightens the loop of how Russian oil sustains its war economy and rebuilds the shadows through which it flows.

How the cap was meant to work

After Russia’s 2022 invasion of Ukraine, the G7 introduced a global price cap: buyers could use Western shipping and insurance only if the oil was sold below US$60 a barrel. The theory was simple: starve Moscow of revenue without destabilizing the market.

In practice, it created a cat-and-mouse game of paperwork and plumbing. When the cap came into effect, the world’s maritime insurers, brokers, and banks became the de facto police. And Russia, whose budget still depends on oil and gas, got creative.

Ukraine’s President Volodymyr Zelenskyy. Image credits: Henry Nicholls – WPA Pool/Getty Images

Tankers began “going dark,” which means switching off location trackers, changing flags, or transferring cargo at sea. Analysts at Windward say that by mid-2025, roughly 36% of Russia’s seaborne exports moved through these opaque channels.

Enter the dark fleet

Walk the piers at Gibraltar or Istanbul and you’ll spot them: older, rust-streaked vessels flying the flags of Panama, Liberia, or Cameroon. Many were purchased cheaply from Greek and Singaporean owners after 2022, when sanctions rendered newer ships unviable.

These tankers operate in a murky legal zone. Their insurers are often shell companies registered in Dubai or Hong Kong. Their crews, drawn from a dozen nations, may have no idea who ultimately owns the cargo.

Russian President Vladimir Putin. Image credits: Contributor/Getty Images

“For most of my career, the vessels I piloted were relatively new. But a couple of years ago I noticed a different kind of tanker—older and rustier, with unfamiliar flags,” said Danish pilot Bjarne Caesar Skinnerup in an interview with KUCB Public Radio.

Ship-to-ship transfers, known as STS operations, have surged. Two tankers meet offshore, pumps and hoses connect, and crude is transferred mid-sea. The hand-off blurs the oil’s origin before it heads to refineries in India, China, or the UAE. The result: Russian barrels rebranded as something else entirely.

Sanctions, but make them selective

Even as Western leaders tout their “ironclad” stance against Russian energy, the latest revelations suggest that the sanctions regime looks more like a sieve than a shield.

The Kremlin uses a dangerous ‘shadow fleet’ to get round our sanctions on Russian oil – helping to pay for the illegal war in Ukraine.

Today, we have imposed the largest package of sanctions against the shadow fleet to date.#StandWithUkrainepic.twitter.com/PCxh7aGF3d

— Foreign, Commonwealth & Development Office (@FCDOGovUK) November 25, 2024

Just this week, Reuters reported that the U.S. excluded Rosneft Germany, a subsidiary of Russia’s state oil giant, from new rounds of sanctions, effectively allowing it to continue operating within Europe’s largest economy.

The rationale? Economic stability. The message? Sanctions are fine until they start to sting at home.

In parallel, another Reuters investigation uncovered how an insurer based in New Zealand quietly underwrote tankers moving sanctioned Iranian and Russian oil, keeping illicit flows alive under Western noses.

It’s a case study in what energy analysts call “policy performativity,” or the idea that governments perform outrage for headlines but quietly maintain supply routes when their economies depend on them.

Oil pumping units in the Republic of Tatarstan, Russia. Image credits: Stringer/Anadolu via Getty Images

The optics are brutal: while European officials moralize about punishing Russia, their own banks, refineries, and now insurers remain entangled in the same trade web they claim to be severing.

In practice, this means Western consumers are still burning the very oil they believe they’ve boycotted, only laundered through intermediaries and neutral ports.

The money still flows

The discounts are attractive. India’s refiners, for instance, have been buying Russian Urals crude at $10 to $15 below Brent. That keeps domestic fuel prices lower and allows the Kremlin to keep selling.

Economist Kim Donovan told the Atlantic Council that each loophole-running cargo “has a direct and immediate impact on Russia’s war profits.”

Even at a discount, export volumes near 4.5 million barrels per day keep money trickling into Moscow’s budget.

Western institutions haven’t fully cut the cord either. Complex re-insurance layers, dollar-clearing systems and correspondent banking mean that some Western capital still brushes the edges of these trades. It’s not deliberate collusion; just how entangled global finance is.

Why markets and governments tolerate it

There’s a cynical logic behind the leaks. Completely blocking Russian exports would push oil prices up, feeding global inflation and angering voters. So policymakers have quietly tolerated a little smuggling in exchange for stability.

The UK recently sanctioned another 44 tankers, but admitted enforcement gaps remain.

“Russia will always find new ways to circumvent sanctions,” said Mitchell Robitaille of Global Affairs Canada.

Meanwhile, the environmental risks rise. Many shadow-fleet tankers are over 20 years old, uninsured, and operating without proper maintenance. One Canadian adviser warned they are “illegal, sub-standard, uninsured vessels … a terrifying prospect” if they stray into sensitive waters like the Arctic.

The Lukoil signal

The headquarters of Lukoil in Moscow. Image credits: Contributor/Getty Images

On 27 October, Bloomberg reported that Lukoil, Russia’s second-largest oil company, plans to sell off its remaining foreign assets to focus on the domestic market.

The move, analysts say, shows how hard sanctions are biting. But it also underscores how the system adapts: as corporations retreat, a web of private traders and ghost fleets step in to keep exports alive.

By shifting control to less traceable intermediaries, the Kremlin insulates itself while preserving revenue streams. The Lukoil decision might tighten the bottleneck for legitimate trade, but it also incentivizes more gray-market flows.

Who wins, who loses?

Winners: intermediaries, insurers and refiners who pocket the discount margins.

Losers: global transparency, environmental safety and ultimately Ukrainian civilians, because each evaded sanction helps sustain the war economy.

For ordinary consumers, the impact is hidden in the pump price. Sanctions make logistics costlier, shadow shipping adds inefficiencies, and the market stays volatile. That’s why inflation remains sticky even as central banks insist it’s cooling.

The impact is hidden in the pump price. Image credits: Erik McGregor/LightRocket via Getty Images

The policy trap

Western capitals face a bind. Tighten enforcement and risk $100-a-barrel crude; relax it and accept hypocrisy.

Some economists propose targeting the ecosystem around the oil itself:

- Flag states: ban or heavily fine registries enabling opaque ownership.

- Insurers: extend sanctions to non-Western underwriters who knowingly cover shadow-fleet vessels.

- Ports: deny bunkering or docking rights to tankers with tampered AIS histories.

- Transparency: publish vessel-level data and STS events to crowdsource monitoring.

None of this is easy. Many developing nations rely on discounted Russian oil to keep energy affordable. And Western leaders, facing elections, fear another spike in petrol prices more than they fear moral inconsistency.

Meanwhile, in Africa

While the Global North scratches each other’s faces in cat fights, landlocked Burkina Faso’s discovery of oil (and other upstream energy assets) has triggered a recalibration of power in the Sahel.

Under Ibrahim Traoré’s junta, the country has pivoted away from its former “Françafrique” dependence and leaned into partnerships with Gazprom and Rosatom, signalling a shift in who controls the tap of extractive revenue.

The recent (debunked) headlines about ‘Russia’s discovery of oil in Burkina Faso’ sound almost like something from a 19th-century explorer’s diary, as if hydrocarbons only come into existence once a foreign power identifies and exploits them.

Daily life continues in Ouagadougou, the capital of Burkina Faso. Image credits: Muhammed Nuri Erdogan/Anadolu via Getty Images

But the language itself betrays the deeper reality: that even as the West sanctions Russian crude, Moscow is quietly extending its own extractive reach into Africa.

The promise of local oil in Africa is sovereignty: domestic refining, local infrastructure, and deeper national participation in oil flows. But the risks echo the resource-curse blueprint: heavy foreign involvement, opaque deals, and elite capture—turning oil into a new vector of neocolonial extraction rather than genuine independence.

Burkina Faso’s oil fields, long under-explored and now being developed through Russian-linked ventures, would form part of the same network of energy diplomacy that props up the Kremlin’s war economy.

What’s sold as “South-South cooperation” can just as easily replicate the neocolonial template—one where external actors, whether Western or Russian, dictate the terms of extraction. Though the news may be fake, the song remains the same.

The “sanctions paradox” becomes even starker. The same Russian oil firms shut out of Europe could find new lifelines in the Global South, where Western-designed weak regulatory frameworks and a desire to shake off this influence make such deals politically convenient.

The Peshkabir Oil Field in Iraq. Image credits: Ismael Adnan Yaqoob/Anadolu via Getty Images

The quiet continuity of crude

Off Kalamata tonight, another tanker is likely idling with its lights dimmed. Somewhere in Dubai, a shell insurer is drafting cover notes. In Mumbai, a refinery accountant is calculating margins on a cargo labelled “origin: unknown.”

The oil hasn’t stopped flowing; it has merely gone underground. The sanctions have slowed, rerouted and disguised it, but not broken it. As long as the global economy runs on hydrocarbons and politics runs on cheap fuel, Russia’s oil will find a way out.

The price cap may have kept markets calm, but it also revealed an uncomfortable truth: in a world this interconnected, no embargo is ever watertight.

Poll Question

Thanks! Check out the results:

1k+views

Share on Facebook

17

1