At the Port of Antwerp-Bruges in Belgium, thousands of new vehicles—cars, trucks, and tractors—are sitting idle. These are not unsold stock, but rather exports stuck in limbo.

They were meant for the United States but are now held back by a new wave of tariffs announced by President Donald Trump earlier this year.

As these vehicles wait to be shipped, American consumers are beginning to feel the consequences, from higher prices to fewer options.

- Trump’s new tariff raises taxes on European vehicle imports by 25%, up from the previous 2.5%.

- These can lead to a $4,000 car costing $12,500, increasing the overall cost of living in the U.S.

- As of now, it is impossible to manufacture a fully American car.

- The EU has threatened retaliatory tariffs worth €72 billion on U.S. goods unless a deal to reduce auto tariffs is reached by August 1.

American consumers are feeling the consequences of increased tariffs on European vehicles

Image credits: Matthias Balk/Getty Images

Trump’s new trade measures have placed a 25% tariff on imported vehicles and parts from Europe. That’s a sharp increase from the previous 2.5% rate that had been in place for years.

These tariffs are part of what the president calls his “Liberation Day” package, designed to boost domestic manufacturing by making foreign goods more expensive.

But the effects are not just hitting European manufacturers, they’re also squeezing American buyers and raising inflation.

In just the first six months of 2025, exports of new passenger cars and vans from Antwerp to the U.S. dropped nearly 16%. Exports of larger equipment like trucks and construction vehicles fell by over 31%.

Thousands of vehicles sit idle at EU port as Trump’s tariffs leave their mark

Port of Antwerp-Bruges figures show 15.9% drop in export of cars, vans, trucks and tractors to US

The Port of Antwerp-Bruges has been turned into a giant car park with thousands of cars, vans, trucks… pic.twitter.com/WwJiUfEzuN

— Mike Alderson FRSA (@OpenEyeComms) July 15, 2025

Some of these vehicles cost more than $100,000, and the 25% tariff adds tens of thousands of dollars to their price tags. American businesses that rely on imported trucks or tractors are facing unexpected costs. And for individual buyers, a European SUV or sedan may now be out of financial reach.

At the same time, a pressing issue for Trump is that Europeans don’t take American cars. The imbalance in transatlantic trade is also part of the dispute. In 2022, the U.S. imported nearly 700,000 vehicles from the EU, worth about $37 billion.

In contrast, only about 116,000 U.S.-made cars were sold in Europe, worth around $5.2 billion.

A possible explanation is that given Europe’s narrow streets and cobblestones, European buyers tend to prefer smaller, more fuel-efficient cars. American models are often larger and built for long highways.

While these trade imbalances have led Trump to hike tariffs on EU car imports, such a move may ultimately hurt the U.S. more than the EU—since European automakers like BMW, Mercedes and Audi already manufacture many of their vehicles in the U.S., while U.S. brands like Ford and GM have downsized in Europe.

Trump: Mercedes-Benz… in South Carolina. They build everything in Germany and they assemble it here… They don’t build cars. They take them out of a box and assemble them. Could have our child do it. pic.twitter.com/gI4b6QdWUC

— Acyn (@Acyn) October 15, 2024

The financial burden goes beyond just the sticker price. According to the Anderson Economic Group, the new tariffs could increase the cost of a single imported car by $4,000 to $12,500, depending on the model and where it’s built.

The broader effect of the hiked tariffs is visible in rising inflation. The inflation rate is up by 2.7% this year, and tariffs on the auto industry, among others like steel and aluminum, and agriculture and technological equipment, has made a huge impact on the increasing cost of living.

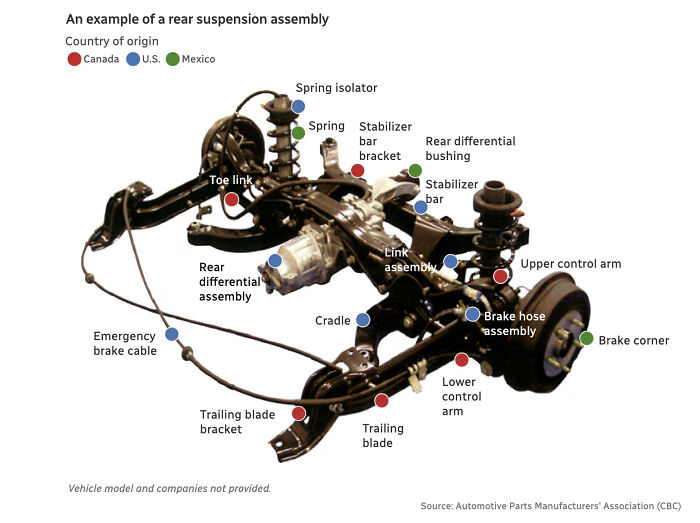

Trump argues that buyers can avoid these added costs by purchasing American-made vehicles. But industry experts say there’s no such thing as a fully American-made car today.

According to CNBC, building a 100% American-made car would add $10,000–$20,000 per vehicle and is nearly impossible due to supply chain, labor, and raw material constraints.

Currently, it is impossible to make a fully American car

Image credits: CBC News

CNBC automotive industry reporter Mike Wayland likened this to a Ferrari: low production and high costs.

Modern vehicles are made with complex supply chains that span the globe. Even American brands source up to 40% of their parts from abroad. Tesla, for instance, makes its cars in the U.S., but still imports as much as a quarter of its parts from Mexico.

Beyond cars, tariffs could impact goods ranging from clothing and wine to medical equipment and consumer electronics. These industries either import directly from Europe or rely on European technology and materials.

Image credits: Deb Cohn-Orbach/Getty Images

Small and mid-sized U.S. businesses that depend on these imports and don’t have the financial cushion to absorb higher costs may find themselves squeezed or forced to pass the increase to customers.

From a macroeconomic standpoint, these trade restrictions could slow U.S. growth. Higher prices weaken consumer spending, which makes up about 70% of the American economy.

Meanwhile, European exporters are not taking this quietly: The EU is preparing its own set of retaliatory tariffs, potentially targeting American goods like aircraft and parts, machinery, electrical products, and chemicals.

According to Politico and Bloomberg, the EU’s latest retaliatory tariff list includes €72 billion worth of goods. The EU says they’re still trying to negotiate a deal before Trump’s August 1 deadline, but they’re also preparing for the worst.

The EU has prepared retaliatory tariffs on American aircraft, chemicals, and machinery

Image credits: Win McNamee/Getty Images

In the latest effort to strike a deal before the deadline, the EU has also offered a straightforward solution: a tit-for-tat reduction in car tariffs.

Under this new proposal, the EU would drop its 10% duty on U.S. car imports if the United States lowers its own tariffs on European cars to below 20%.

Håkan Samuelsson, chief executive of Swedish carmaker Volvo Cars, told The Financial Times that even if the tariffs were lower than 20%, the company would not be able to manage without export credits.

Image credits: Krisztian Bocsi/Getty Images

BMW chief executive Oliver Zipse further added: “In our discussions, I think we came a long way to make it clear: if you endanger that [export] model … the US will lose.”

The outcome of these negotiations could shape the U.S.-EU economic relationship for years to come. If no deal is reached by August 1, 30% tariffs will kick in, and the EU has warned trade with the U.S. would become “almost impossible.”

A tariff of “30%, or anything above 30%… has more or less the same effect. So, practically it prohibits the trade,” the EU’s Commissioner for Trade and Economic Security Maroš Šefčovič said on Monday.

At the same time, Trump says his administration is “always open to talk.”

The elites in the US have long wanted to shift the tax burden away from the wealthy and onto the middle and working classes. The tariffs are a flat tax on goods that impact the working class and middle class disproportionately. It is interesting that America has finally started to move forward with this new system of taxation.

The elites in the US have long wanted to shift the tax burden away from the wealthy and onto the middle and working classes. The tariffs are a flat tax on goods that impact the working class and middle class disproportionately. It is interesting that America has finally started to move forward with this new system of taxation.

15

1