The U.S. gross national debt has surged to a record $37 trillion, underscoring that even income from Donald Trump’s sweeping tariffs has not slowed its growth.

A Treasury Department report revealed the startling figure on Tuesday

It comes after the Congressional Budget Office (CBO), in January 2020, predicted that the gross national debt would not reach $37 trillion until 2030.

- The U.S. national debt has reached a record $37 trillion, surpassing 2030 predictions, despite tariff revenue boosts.

- COVID-19-related federal spending under Trump and Biden accelerated debt growth beyond earlier Congressional Budget Office projections.

- The Big Beautiful Bill is projected to add $4.1 trillion to the debt over the next 10 years.

- Rising debt impacts everyday Americans with costlier goods, higher borrowing costs, and slower wage growth, warns the Government Accountability Office.

The national debt has surged to $37 billion, even amid Donald Trump’s tariffs

Image credits: Costfoto/NurPhoto via Getty Images

Unprecedented federal spending and borrowing during the COVID-19 pandemic, led by both then-President Donald Trump and former President Joe Biden, helped accelerate the debt far beyond past projections.

Recent spending measures, including Trump’s Big Beautiful Bill, are also a cause for concern.

The CBO expects that the sweeping legislative package will add $4.1 trillion to the national debt over the next 10 years.

Wendy Edelberg, a senior fellow at the Brookings Institution, said the legislation means “we’re going to borrow a lot over the course of 2026, we’re going to borrow a lot over the course of 2027, and it’s just going to keep going.”

A Treasury Department official told AP that several expenditures had contributed to an overall increase in spending, including growing interest payments on the public debt and cost-of-living increases to Social Security payouts.

Image credits: Soeren Stache/picture alliance via Getty Images

The impact of rising federal debt on everyday Americans includes more expensive goods and services, higher borrowing costs for cars and mortgages, and slower wage growth, according to the Government Accountability Office.

In January 2024, the U.S. recorded $34 trillion in debt, and this increased to $35 trillion in July. By November 2024, it had reached $36 trillion.

The data emphasizes how rapidly the debt is increasing, with an additional trillion being added roughly every five months.

At the current rate, the Joint Economic Committee believes that another trillion could be added in just 173 days.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, said the debt must serve as a wake-up call.

Image credits: Chip Somodevilla/Getty Images

“Hopefully this milestone is enough to wake up policymakers to the reality that we need to do something, and we need to do it quickly,” she said in a statement.

The rising debt is also linked to the growing budget deficit, which was 20% higher this July compared to the same period last year, the Treasury Department figures show.

It remains at a record high despite increased revenue from Trump’s tariffs, which saw $21 billion in July, marking a 273% increase in customs revenue over the same period last year.

AP reported that revenues collected by the government are not enough to outpace federal spending.

This could change if companies are forced to import goods when their stock inventory runs out, leading to more tax revenue.

Some analysts, including the Committee for a Responsible Federal Budget, estimate that tariffs could generate about $1.3 trillion in revenue over President Trump’s four-year term in office

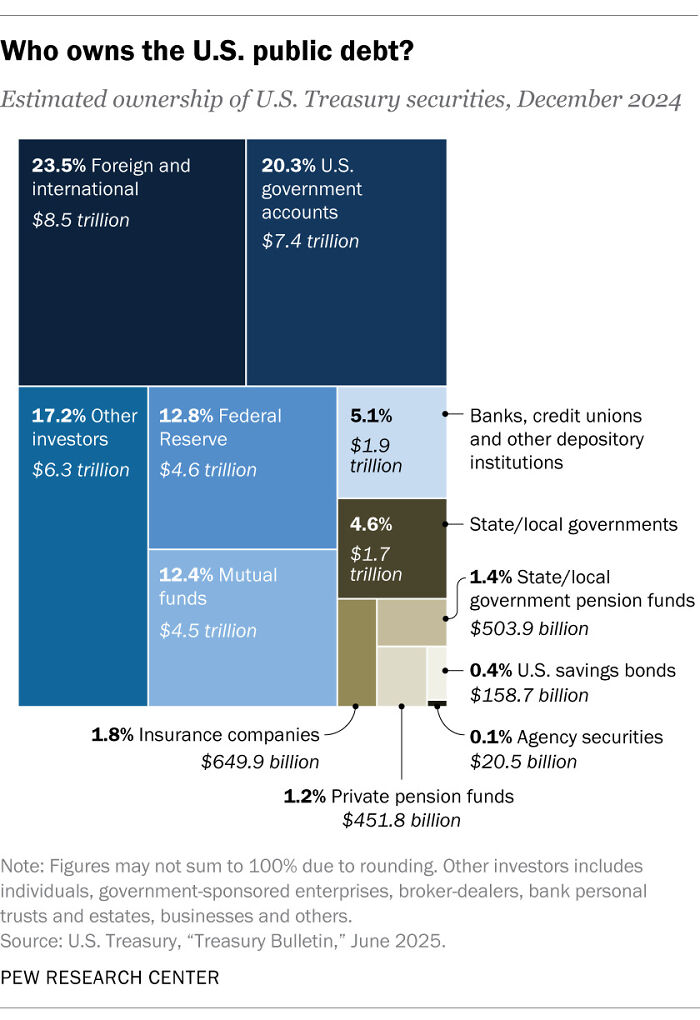

Japan is the biggest foreign holder of U.S. debt

Image credits: Pew Research Center

But while that may chip away at the debt, it is unlikely to create a huge reduction in the deficit.

The CBO now estimates that the nation’s debt will exceed $52 trillion by the end of fiscal 2035.

In terms of who holds U.S. debt, the latest figures from March 2025, reported by the Pew Research Center, show that private investors held $24.4 trillion, which is about two-thirds of the national debt.

The Pew Research Center notes that the rest is held in various federal trust funds and retirement programs, or by the Federal Reserve System.

Japan is the biggest foreign holder of U.S. debt, and as of May 2025, it held more than $1.1 trillion, or 3.1%, of the country’s total debt, according to the center.

The UK is the second-biggest foreign holder, with $809.4 billion, or 2.2%, while China follows at third with $756.3 billion, or 2.1%.

17

0