Trump’s $40 Billion Argentina Deal Sparks One Big Question: What’s He Really After?

When the U.S. announced a $40 billion financial assistance package for Argentina earlier this month, the timing and terms raised eyebrows.

The surprise announcement—and the lack of clarity surrounding it—were compounded when U.S. President Trump said the aid would hinge on the success of his Argentine counterpart Javier Milei’s libertarian movement in the midterm elections set for October 26.

- Trump's $40B aid to Argentina ties financial help to Milei's electoral success in October, blurring the lines between policy and political intervention.

- The $40B deal is opaque, with unclear exchange rates, collateral, and a high risk of Argentine default and economic instability.

- Critics warn the deal mainly benefits wealthy investors and hedge funds linked to US Treasury officials, not average Argentines.

- Geopolitically, the US may be pressuring Argentina to cut ties with China, risking sovereignty loss in minerals, energy, and military access.

- The deal sparks domestic backlash in both countries, challenging Trump's America First rhetoric and worsening Argentine social unrest.

“If he doesn’t win, we’re gone,” Trump stated on October 14, following a meeting at the White House with Milei.

The remark came days after the U.S. Treasury initially announced the plan, saying it was aimed at stabilizing “a systemically important U.S. ally in Latin America.”

Yet, Trump left little doubt about his personal imprint on the decision.

Argentine President Javier Milei sings with a band during the presentation of his book ‘La Construccion del Milagro’ (‘The Construction of the Miracle’) in Buenos Aires, Argentina. Image credits: Tomas Cuesta/Getty Images

“Just helping a great philosophy take over a great country,” he said after his meeting with Milei. “Argentina is one of the most beautiful countries that I’ve ever seen, and we want to see it succeed.”

The explicit link between political outcomes and foreign financial assistance, analysts say, is a continuation of Trump’s pattern of personalizing foreign policy decisions—a trait that has upended conventional diplomatic etiquette. For some observers, it blurs the line between economic stabilization and political intervention.

“It’s very much an example of a policy that, like many policies today in the United States, came about not because of policy analysts or a long-term strategy but rather the whims of President Trump,” says Professor Mark P. Jones, a fellow in Latin American studies at Rice University’s Baker Institute, who has studied Argentina for decades.

Donald Trump and Javier Milei at the White House on October 14. Image credits: Kevin Dietsch/Getty Images

“President Trump likes President Milei and was approached to try to help Milei as he approaches these crucial October midterms,” he added.

According to Jones, the plan’s principal goal is to avoid a run on the Argentine peso in order to bolster Milei’s chances of success in those elections, after his Liberty Advances party suffered a crushing defeat in a key provincial election in early September.

A similar outcome on October 26 would undermine Milei’s ability to push ahead with an agenda that has seen deep austerity measures generate significant social turmoil since he became president in December 2023.

An opaque arrangement

The $40 billion pledge comes in the form of a $20 billion currency swap agreement and $20 billion in private financing, on top of direct purchases of Argentine pesos on the open market. However, the details remain opaque.

Neither side disclosed the agreed exchange rate—with the peso hitting a new low against the dollar after the announcement—and it is not even known exactly how much the Treasury has invested in the direct purchases. Crucially, it is unclear what collateral, if any, underpins the arrangement.

Milei supporters during his arrival in Rosario, Argentina, to a closing campaign rally ahead of the mid-term election. Image credits: Tomas Cuesta/Getty Images

According to Dr. Juan Gabriel Tokatlian, associate professor of international relations and former vice-chancellor at the Universidad Torcuato Di Tella in Buenos Aires, the opacity is typical of Milei, as well as being characteristic of Trump, “not only in the bilateral relationship, but also in the relationships that each has with other international actors.”

On the question of collateral, Tokatlian highlights a major bailout by the U.S. in the 1990s that saw Mexico put up future oil revenues as security against the funds it received.

“[But] here we do not know what Washington intends to do in the event that this swap is not returned,” he says.

For Jones, that outcome appears to have a high probability, given Argentina’s history of defaults on debts.

“Argentina is more likely to default than not,” he says. “There’s a realistic possibility that what comes out of this $40 billion is essentially the propping up of the Milei administration to allow it to navigate the midterms and to allow many investors to offload their positions in Argentina.”

Milei walks among supporters in Rosario on October 23. Image credits: Tomas Cuesta/Getty Images

A windfall for the connected

Among those investors, analysts say, are well-connected figures in both countries.

According to Professor Emeritus Pablo Pozzi, a social historian who taught for 30 years at the University of Buenos Aires, the deal is “a poor one for everyone involved—except those already profiting from it.”

He says the swap allows Argentina’s wealthiest businessmen and foreign bondholders “to buy dollars cheaply and move them out of the country,” repeating a familiar cycle in which public money exits through private channels.

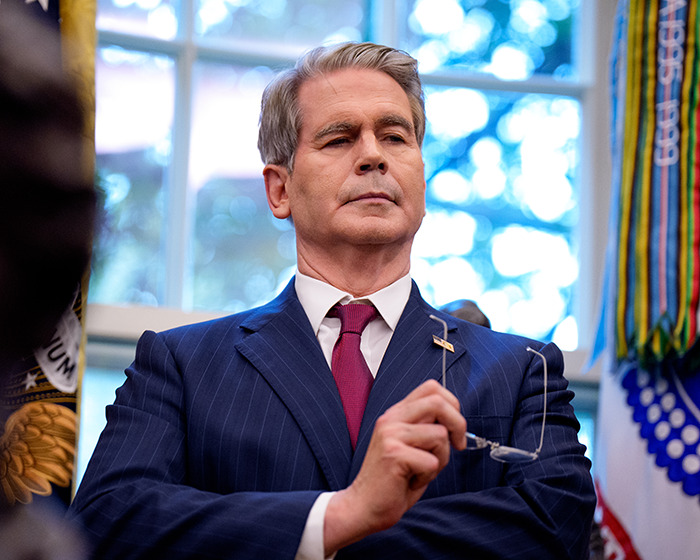

Pozzi notes the overlapping ties between Argentine Economy Minister Luis Caputo, U.S. Treasury Secretary Scott Bessent—a former fund manager himself—and several U.S. hedge funds holding Argentine debt.

Milei is known for his austerity measures. In this photo from 2023, just months before he was elected president, he yields a chainsaw as a symbol to drastically cut government spending. Image credits: Tomas Cuesta/Getty Images

“The connection between the U.S. Treasury and the very funds most at risk is obvious,” Pozzi says. “It’s a bailout dressed as diplomacy.”

Jones echoed those concerns: “There’s a strong suspicion that given Bessent’s ties to hedge funds and other investment groups, the end outcome of all of this may be that those groups end up winning and the American taxpayer ends up losing.”

While Tokatlian partly sees the move as an opportunity for the Trump administration to demonstrate its willingness to accommodate an ally—having rarely “offered any carrots” on the international stage—he also highlights that four of Milei’s top ministers, including Caputo, are former J.P. Morgan executives.

“We are seeing financial power take political control,” he says, adding that the fusion of Wall Street interests with Argentina’s economic policy could “turn the country into a laboratory for speculative finance.”

Milei and Minister of Economy Luis Caputo in July 2025. Image credits: Tomas Cuesta/Getty Images

Caputo is a former J.P. Morgan executive. Image credits: Tomas Cuesta/Getty Images

Concessions with a strategic price

Beyond finance, the arrangement also carries geopolitical overtones. Tokatlian suggests that Washington may view Argentina as a test case for rewarding governments that distance themselves from China.

In the months preceding the deal, Buenos Aires halted a Chinese-backed nuclear project, froze imports for a joint astronomical telescope, and blocked further lithium investments from Chinese firms.

The message to Washington, he says, is unmistakable: Argentina is open to concessions.

For the U.S., those gestures offer a rare opportunity to showcase an ally embracing its line after years of friction in Latin America.

Tokatlian characterizes the policy as a modern form of the Monroe Doctrine, which declared U.S. hegemony over Latin America two centuries ago.

The approach, he warns, “may buy influence today, but at the cost of long-term legitimacy.”

Prof. Pablo Pozzi notes overlapping ties between Caputo, U.S. Treasury Secretary Scott Bessent (pictured above), and several U.S. hedge funds holding Argentine debt. Image credits: Andrew Harnik/Getty Images

Pozzi expresses concern that those concessions could deepen Argentina’s dependence. With repayment uncertain, he says, “the government may be forced to trade away its sovereignty piece by piece”—through mining rights, energy contracts, or even military access.

Such arrangements, he adds, echo past eras when economic rescue came with strategic strings attached.

It’s a prospect Jones also envisages, with a default potentially leading the Trump administration to extract some form of benefit in exchange for debt forgiveness or a bridge loan.

“Such as privileged access to Argentine minerals or essentially barring the Chinese government or Chinese companies from being active in certain industries, or providing for a U.S. naval base in Tierra del Fuego,” he says.

A Milei supporter wears a MAGA hat and an Argentine national soccer team jersey in Buenos Aires in 2024. Image credits: Tomas Cuesta/Getty Images

Domestic friction for both leaders

The deal raises major questions in both countries, with Democrats leading criticism of the move but objections emerging across the political divide.

Republican legislators representing rural states are particularly concerned about the possibility of Argentina’s agricultural capacity being bolstered at a time when U.S. farmers are being squeezed by tariffs implemented by Trump. It also clashes with his overtly nationalist rhetoric.

“It flies in the face of the whole America First philosophy of the MAGA movement because it is putting Argentina first,” Jones points out.

Meanwhile, inside Argentina, the deal has intensified frustration over inequality and austerity. Almost two years into Milei’s presidency, inflation remains in double digits, public-sector wages have stagnated, and social spending has been cut to levels unseen since the 1990s.

Donald Trump boards Marine One to attend the UN General Assembly in September. Image credits: The White House

According to Pozzi, ordinary Argentines see little benefit from foreign lifelines that “shore up the peso for a few weeks but never reach the people.” Many voters, he adds, are simply “tired of seeing money come in and vanish.”

Jones says a weak showing for Milei in the upcoming election could accelerate the peso’s decline and trigger catastrophic capital flight.

“All it would take is a tweet by Trump on Sunday night—disappointed in the Argentine public not backing Javier Milei—and Monday morning would be a [financial] bloodbath,” he says.

Poll Question

Thanks! Check out the results:

1k+views

Share on Facebook

18

1